Hereford auto title loans offer quick cash with lower interest rates by using vehicle titles as collateral, ideal for emergencies and debt consolidation. Requirements include being 18+, having a driver's license, verifiable income, and clear vehicle ownership. While accessible, these loans carry significant risks, including potential vehicle loss if repayments fail, emphasizing the need for thorough financial assessment before application.

“Hereford auto title loans have emerged as a financial solution for those in need of quick cash. This article delves into the intricacies of these loans, offering a comprehensive guide for residents of Hereford. We’ll explore what these loans entail, who can apply, and the key benefits and risks involved. Understanding Hereford auto title loans is essential for making informed decisions regarding short-term financial needs.”

- Understanding Hereford Auto Title Loans

- Eligibility Criteria for Loan Applicants

- Benefits and Risks of Securing a Title Loan

Understanding Hereford Auto Title Loans

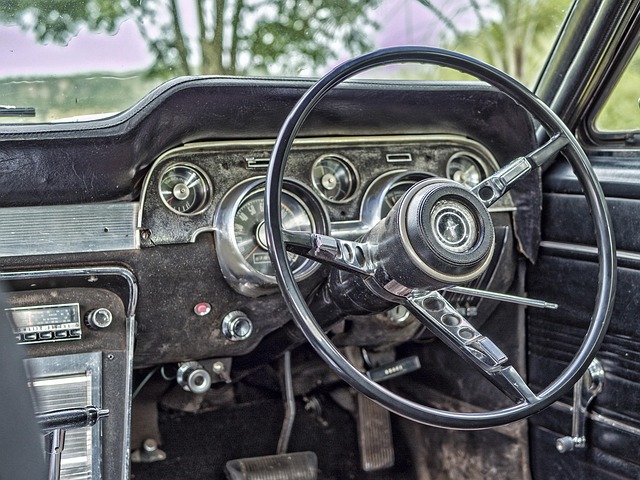

Hereford auto title loans are a type of secured loan where borrowers use their vehicle’s title as collateral. This innovative financing option is designed to provide quick access to emergency funds for individuals in need. By leveraging the value of their vehicle, borrowers can obtain a loan with relatively lower interest rates compared to traditional unsecured loans.

These loans are particularly useful for those facing unexpected expenses or looking to consolidate debt. With an online application process, it’s now more convenient than ever to explore this alternative lending solution. Borrowers simply submit necessary documents, including their vehicle’s title, and wait for a quick approval. Once approved, the loan funds can be used for various purposes, such as paying off high-interest credit card debt or covering urgent expenses, ultimately helping individuals regain financial stability with a clear path to repayment and, upon successful payoff, the restoration of their vehicle’s title.

Eligibility Criteria for Loan Applicants

To be eligible for Hereford auto title loans, borrowers must meet specific criteria set by lenders. Typically, applicants need to be at least 18 years old and have a valid driver’s license to establish their identity. Lenders will also verify income and employment history, although self-employed individuals or those with irregular income streams may still qualify. A clean credit record is advantageous but not always mandatory, making Hereford auto title loans accessible to a broader range of borrowers.

The primary collateral for these loans is the borrower’s vehicle, so ownership rights and clear vehicle registration are essential. Lenders will assess the vehicle’s value to determine the loan amount offered, which can be a significant advantage when it comes to emergency funding. Unlike traditional bank loans with lengthy application processes, Hereford auto title loans often promise quick approval, making them an attractive option for those in need of immediate financial assistance, especially compared to Houston title loans from other sources.

Benefits and Risks of Securing a Title Loan

Hereford auto title loans can offer a range of benefits for individuals seeking quick funding. One of the primary advantages is the speed and ease of the loan process. With San Antonio loans, borrowers can obtain approval in a matter of minutes, providing them with immediate access to the funds they need. This makes Hereford auto title loans an attractive option for those facing unexpected expenses or financial emergencies. The collateral-based nature of these loans also means that interest rates are often lower than traditional personal loans, making it a cost-effective solution.

However, along with the benefits come certain risks. One significant drawback is the potential loss of one’s vehicle if unable to repay the loan. Unlike conventional loans, failing to meet the repayment terms can result in the lender repossessing the title of your car. Additionally, Hereford auto title loans may have higher fees and charges attached, which can increase the overall cost of borrowing. It’s crucial for borrowers to carefully consider their financial situation and ensure they can comfortably manage the loan repayments to avoid these risks.

Hereford auto title loans can be a convenient financial solution for those in need of quick cash. By using your vehicle’s title as collateral, you gain access to funds without strict credit requirements. However, it’s crucial to understand the benefits and risks involved. While these loans offer flexibility, defaulting on payments may lead to severe consequences, including repossession. Always carefully consider your financial situation before securing a Hereford auto title loan.