Hereford auto title loans offer flexible financing for borrowers using their vehicle's title as collateral. To secure competitive rates and terms, conduct market research, prepare financial documents, leverage positive credit history, and negotiate with confidence. Researching rates, understanding creditworthiness, and presenting a compelling case can lead to significant savings on these alternative loans.

Looking to secure a lower interest rate on your Hereford auto title loan? This comprehensive guide is your roadmap. We’ll walk you through the ins and outs of Hereford auto title loans, providing a clear understanding of how they work and empowering you with effective negotiation strategies. By mastering these tactics, you can maximize your savings and get the best terms possible. Whether you’re a first-time borrower or an experienced loan holder, this article offers practical tips to ensure you get a fair deal on your Hereford auto title loan.

- Understanding Hereford Auto Title Loans: A Comprehensive Overview

- Strategies to Lower Interest Rates: Do's and Don'ts

- Maximizing Your Negotiation Skills for Better Loan Terms

Understanding Hereford Auto Title Loans: A Comprehensive Overview

Hereford auto title loans are a type of secured loan where borrowers use their vehicle’s title as collateral. This innovative financing option allows car owners in Hereford to access immediate funds by leveraging the equity in their vehicles. The process involves offering the vehicle’s title to a lender, who then provides a loan based on the vehicle’s appraised value. Unlike traditional loans that require extensive documentation and credit checks, Hereford auto title loans often have simpler eligibility criteria, making them accessible to a broader range of borrowers.

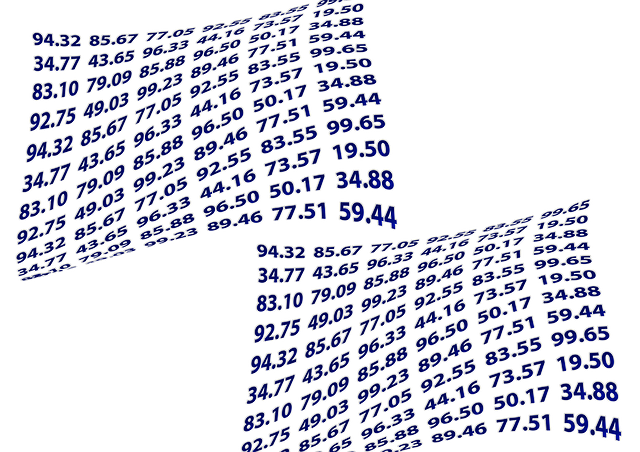

Understanding the mechanics behind these loans is crucial for negotiating favorable terms. Loan terms can vary significantly between lenders, affecting interest rates and repayment periods. Borrowers in Fort Worth or Dallas seeking title loans should explore different options, compare interest rates, and consider loan terms that align with their financial capabilities. By doing so, they can secure lower interest rates on their Hereford auto title loans, ensuring a more manageable borrowing experience.

Strategies to Lower Interest Rates: Do's and Don'ts

When negotiating lower interest rates on Hereford auto title loans, it’s crucial to employ strategic approaches that can lead to favorable terms. Here are some do’s and don’ts to guide your process. Do thoroughly research the market for current loan rates; this gives you a baseline for what is reasonable. Additionally, prepare by organizing your financial documents, as lenders often require proof of income and employment stability. Presenting yourself as an informed and responsible borrower can enhance your negotiating power.

On the contrary, don’t settle for the first offer presented. Lenders may initially quote high rates, but with persistence and a solid understanding of your rights, you can secure better terms. Avoid providing unnecessary personal information or signing any documents without reading and comprehending the terms. Instead, focus on emphasizing your qualifications for a lower rate—for instance, excellent credit history, timely repayments on previous loans, or the ability to offer collateral like a truck title (as in the case of truck title loans). Utilizing these strategies can facilitate the loan approval process while ensuring you get the best possible deal on your Hereford auto title loan.

Maximizing Your Negotiation Skills for Better Loan Terms

When negotiating for lower interest rates on Hereford auto title loans, it’s crucial to leverage your negotiation skills effectively. First, prepare by researching market rates for similar San Antonio Loans and understanding your creditworthiness. Have your financial statements ready so you can demonstrate your ability to repay promptly, which may sweeten the deal. Additionally, consider the value of your vehicle; if its worth has increased since the last loan, use this leverage to request a lower rate.

During negotiations, remain calm and confident. Clearly communicate your desired outcome—a reduced interest rate—and be ready to explain why you deserve it. Highlight any unique circumstances or challenges that have arisen since securing the initial loan. Remember, lenders want to close deals quickly, so they may be more inclined to offer better terms if they see a clear path to repayment and a mutually beneficial agreement. A well-presented case could lead to significant savings over the life of your Hereford auto title loan, ensuring faster repayment and less financial strain.

Negotiating lower interest rates on Hereford auto title loans is a strategic process that can save you significant money over the life of your loan. By understanding how these loans work and employing effective negotiation tactics, you can secure more favorable terms. Remember, being informed and prepared are key to getting the best deal possible on your Hereford auto title loan.