Hereford auto title loans have gained popularity as a quick cash solution, utilizing vehicle equity. To refinance these loans, gather essential documents, evaluate your financial situation, compare terms from various providers, and prepare to negotiate better conditions. After refinancing, manage your new loan terms effectively, maintain timely payments for improved credit score, and explore direct deposit options. Leverage your vehicle's equity wisely for long-term financial health through continued refinancing or other opportunities.

Looking to refinance your Hereford auto title loan? This comprehensive guide is your roadmap to success. We’ll break down the process step by step, from understanding the basics of Hereford auto title loans and gathering essential documents to executing the refinance and maintaining financial stability post-refinance. By following these strategies, you can navigate the process smoothly and make informed decisions for your future.

- Understanding Hereford Auto Title Loans: Unlocking the Process

- Preparing for Refinancing: Gathering Essential Documents and Evaluating Options

- Execution and Post-Refinance Strategies: Ensuring a Smooth Transition and Future Financial Health

Understanding Hereford Auto Title Loans: Unlocking the Process

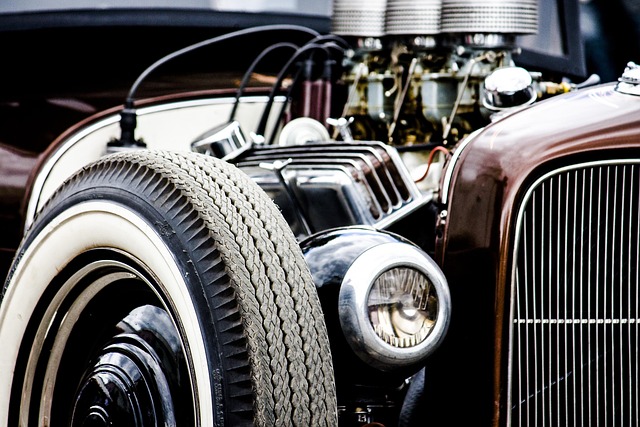

Hereford auto title loans have emerged as a popular financial solution for many individuals seeking quick cash. This type of loan utilizes your vehicle’s equity, allowing you to access funds by leveraging its value. It’s a straightforward process where lenders offer short-term financing secured against your car’s title. The beauty lies in its accessibility; even those with less-than-perfect credit can qualify.

Understanding the mechanics is key to a successful refinance. When you refinance a Hereford auto title loan, it involves repaying the existing debt and replacing the old loan with a new one. This process often results in lower interest rates and more favorable terms, providing relief from high-interest payments. With quick approval times, individuals can regain control of their finances while maintaining vehicle ownership.

Preparing for Refinancing: Gathering Essential Documents and Evaluating Options

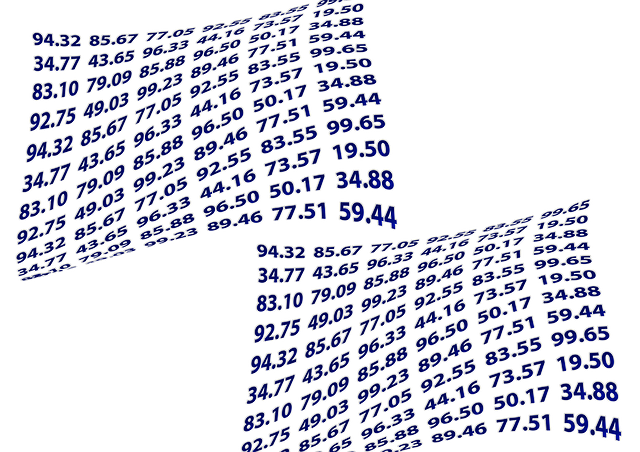

Before refinancing your Hereford auto title loans, it’s crucial to prepare thoroughly. Start by gathering essential documents such as proof of vehicle ownership (usually the title), a valid driver’s license, and income verification. These documents are necessary for lenders to assess your eligibility and evaluate your loan options. Additionally, consider your financial situation and goals. Do you want to lower your monthly payments? Are you looking for debt consolidation options, like combining multiple loans into one with potentially lower interest rates? Evaluating these factors will help guide your decision-making process.

For Hereford auto title loans refinancing, explore various loan providers, including banks, credit unions, and specialized lenders, to compare their terms, interest rates, and fees. Understanding the current market rates for semi truck loans or other types of auto title loans can empower you to negotiate better terms. Remember, a well-prepared approach increases your chances of securing favorable refinancing conditions.

Execution and Post-Refinance Strategies: Ensuring a Smooth Transition and Future Financial Health

After successfully refinancing your Hereford auto title loan, executing a smooth transition into your new financial arrangement is paramount. Begin by reviewing your revised loan terms, focusing on interest rates, repayment schedules, and any associated fees. Understanding these details will empower you to manage your budget effectively. Many lenders offer flexible payment plans, allowing for adjustments based on your income and cash flow. This adaptability ensures that repaying your loan aligns with your financial goals without causing undue strain.

Post-refinance, prioritize maintaining a strong relationship with your lender. Timely payments, even if you’ve secured more favorable terms elsewhere, can significantly impact your credit score positively. Additionally, exploring options for direct deposit can streamline your repayment process, enhancing convenience and accuracy. Leveraging your vehicle equity wisely—whether through continued low-interest loan refinancing or other financial opportunities—can open doors to better long-term financial health.

Hereford auto title loans can be a powerful tool for managing finances, but refinancing should be approached strategically. By understanding the process, gathering necessary documents, and employing post-refinance strategies, individuals can successfully navigate this option, achieving better financial terms while maintaining their vehicle ownership. Remember, educated decisions lead to lasting benefits, ensuring a smoother financial journey ahead.