Hereford auto title loans provide quick cash access using vehicle titles as collateral, offering swift approval and flexible terms for unexpected expenses. Ideal for those with limited credit, but risky; repossession possible if repayments fail, requiring careful consideration of eligibility factors beyond vehicle value.

Hereford auto title loans are a powerful tool for those seeking financial solutions. This type of loan, secured by your vehicle’s title, offers a unique opportunity to access cash quickly. In this article, we’ll explore the intricacies of Hereford auto title loans, highlighting their benefits and potential risks. We provide a comprehensive overview, guiding you through the process and helping you make informed decisions to improve your financial stability.

- Understanding Hereford Auto Title Loans: A Comprehensive Overview

- Benefits: How These Loans Can Improve Your Financial Stability

- Risks and Considerations: Protecting Your Financial Health

Understanding Hereford Auto Title Loans: A Comprehensive Overview

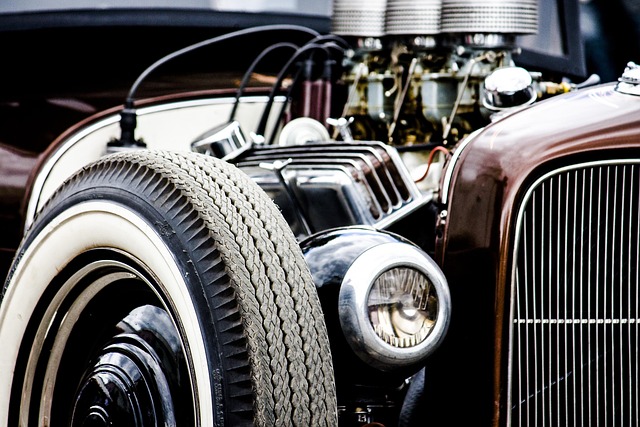

Hereford auto title loans have gained popularity as a unique financial solution for individuals needing quick cash. This alternative lending option involves using your vehicle’s title as collateral, allowing lenders to provide secure and accessible funding. It’s a straightforward process where borrowers can keep their vehicle while accessing a loan, which is particularly beneficial in San Antonio. The approval process is swift, catering to those requiring immediate financial assistance.

Unlike traditional loans that may have stringent requirements, Hereford auto title loans offer flexibility. Borrowers can maintain ownership of their vehicle and retain its full functionality during the loan period. This feature ensures individuals can continue with their daily commutes or business operations without interruptions. With quick approval times, these loans provide a safety net for unexpected expenses, offering a sense of security and peace of mind.

Benefits: How These Loans Can Improve Your Financial Stability

Hereford auto title loans can be a game-changer when it comes to enhancing your financial stability. By leveraging the value of your vehicle, these loans provide a quick and accessible way to access funds. This alternative financing option is particularly beneficial for individuals with limited or poor credit history, as traditional loan applications may face rejections. The process typically involves using your vehicle’s equity as collateral, ensuring a faster approval rate compared to conventional loans.

One of the key advantages is that it allows you to maintain ownership of your vehicle while still receiving much-needed cash. This liquidity can help with unexpected expenses or even accelerating your debt payoff strategy by combining multiple debts into one manageable loan. Moreover, these loans are secured, which means lower interest rates and more favorable repayment terms, ultimately improving your financial health in the long run, especially when compared to unsecured personal loans.

Risks and Considerations: Protecting Your Financial Health

Hereford auto title loans can be a quick solution for those needing cash, but it’s crucial to understand the risks and considerations involved in protecting your financial health. These loans are secured against your vehicle’s title, meaning if you fail to repay the loan as agreed, the lender has the right to repossess your car. This poses a significant risk, especially considering the impact on your daily commute and transportation options.

When exploring Hereford auto title loans or even alternatives like boat title loans or car title loans, it’s essential to evaluate your loan eligibility based on factors beyond just your vehicle’s value. Lenders assess your credit history, income stability, and debt-to-income ratio. It’s important to consider these aspects to ensure you can comfortably manage the loan repayments without causing strain on your financial well-being.

Hereford auto title loans can be a powerful tool for managing your financial health, offering both benefits like quick access to capital and potential risks such as high-interest rates. By understanding these loans and their implications, you can make informed decisions that align with your financial stability goals. Balance the pros and cons, weigh your options carefully, and choose the best course of action for your unique circumstances.