Hereford auto title loans offer a quick cash solution for car owners with poor credit or limited collateral, allowing them to leverage their vehicle's equity. Lenders assess the car's market value and equity for loan eligibility, with daily interest calculated at a set rate. Borrowers keep their vehicles while repaying over time, making it ideal for unexpected expenses. Key aspects include understanding terms, using online apps, and considering extension options; defaulting may lead to repossession.

In Hereford, auto title loans offer an innovative solution for vehicle owners seeking quick funding. This comprehensive guide unravels the intricacies of these loans, providing a clear understanding of how they work and the rights involved. We explore the process, benefits, and protections associated with securing loans against your vehicle’s title. By demystifying Hereford auto title loans, this article empowers readers to make informed decisions regarding their vehicle ownership rights.

- Understanding Hereford Auto Title Loans: A Comprehensive Overview

- How Do Hereford Auto Title Loans Work? Unlocking Vehicle Ownership Rights

- Protecting Your Rights: Owning Your Vehicle Even with a Loan in Hereford

Understanding Hereford Auto Title Loans: A Comprehensive Overview

Hereford auto title loans have gained significant traction as a viable financial option for many individuals. This innovative borrowing mechanism allows lenders to offer unsecured loans backed by an individual’s vehicle ownership rights, providing access to capital for those who might not qualify for traditional bank loans due to factors like bad credit or insufficient collateral.

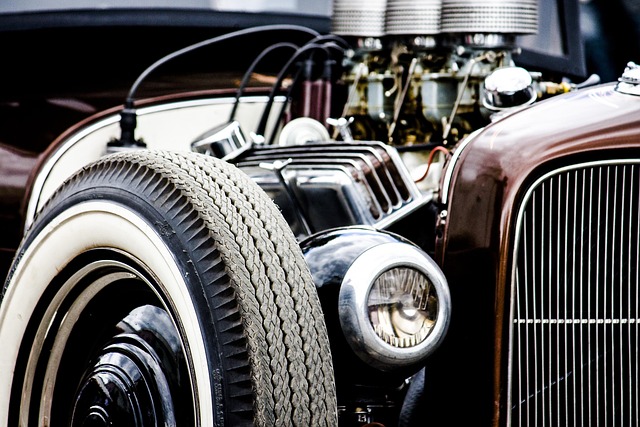

In essence, Hereford auto title loans operate by utilizing the equity of your motor vehicle as security. Lenders process the loan application, assess its viability based on your vehicle’s value and repayment capacity, and disburse funds accordingly. The key advantage lies in their accessibility; even those with poor credit histories can apply. However, it’s crucial to remember that if you’re unable to meet the repayment terms, the lender may have the right to repossess your vehicle. Therefore, a clear understanding of the loan conditions and the potential consequences is essential before committing to a Hereford auto title loan agreement.

How Do Hereford Auto Title Loans Work? Unlocking Vehicle Ownership Rights

Hereford auto title loans are designed to offer vehicle owners a quick and convenient way to access emergency funding by using their car’s equity as collateral. Here’s how they work: when you apply for a Hereford auto title loan, lenders assess your vehicle’s value and determine the maximum amount you can borrow based on that appraisal. This process involves a simple application, requiring basic personal information and details about your vehicle. Once approved, you receive a cash advance against the full market value of your car. Unlike traditional loans, interest rates for Hereford auto title loans are typically calculated as a percentage of the loan amount each day, offering borrowers a fixed repayment period to pay back the funds without worrying about compounding interest.

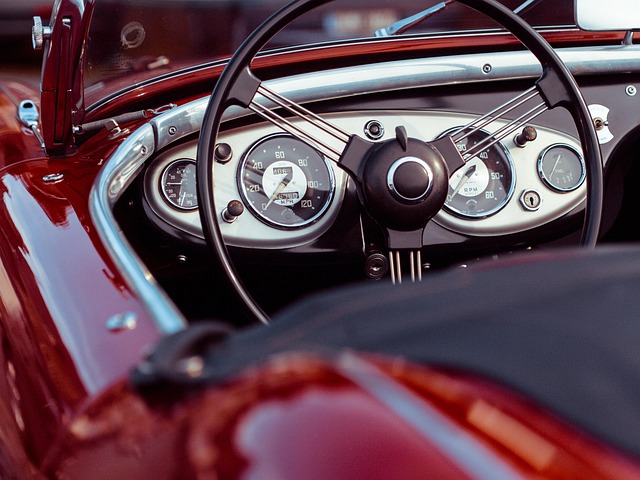

This innovative financing option allows vehicle owners to retain their driving privileges and maintain ownership rights while repaying the loan in manageable installments. It’s particularly beneficial for those needing quick access to cash, such as covering unexpected expenses or emergency funding situations. By using your car as collateral, you can gain immediate financial relief while still having the option to regain full control of your vehicle once the loan is repaid.

Protecting Your Rights: Owning Your Vehicle Even with a Loan in Hereford

When you secure a Hereford auto title loan, it’s crucial to understand that while you’re temporarily handing over ownership of your vehicle to the lender, your rights as a owner are still intact. This means you have the right to drive and maintain your vehicle as long as you meet the loan repayment obligations. Even with the loan on your car, you can enjoy its use and benefits without significant restrictions.

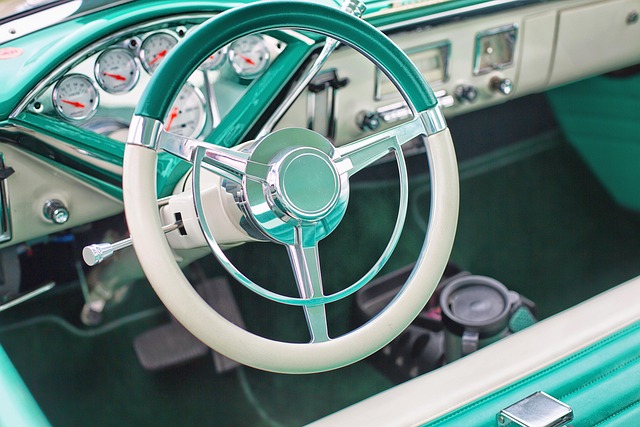

One key consideration is ensuring you fully comprehend the terms of your loan agreement, especially regarding interest rates and repayment conditions. Many lenders offer online applications for convenience, making it easy to apply for a Hereford auto title loan from the comfort of your home. Additionally, if unforeseen circumstances arise, some lenders allow for loan extensions, providing flexibility in managing your finances without compromising your vehicle ownership rights.

Hereford auto title loans offer a unique solution for individuals seeking vehicle ownership while managing debt. By leveraging the equity in their vehicles, borrowers can access much-needed funds without sacrificing full possession. This alternative financing method ensures that residents of Hereford can maintain control over their assets and enjoy the freedom to use their vehicles as collateral. With careful consideration and responsible borrowing practices, it’s possible to navigate financial challenges while preserving ownership rights.